International inventory markets slipped and the worth of oil declined after a brand new pressure of coronavirus sweeping by components of Britain sparked fears over additional lockdowns throughout the continent.

The FTSE All World index fell 0.7 per cent on Monday, on tempo for its worst day since November 30. The drop was led by a sell-off within the European buying and selling day, with the region-wide Stoxx 600 closing down 2.3 per cent and London’s FTSE 100 sinking 1.7 per cent.

The declines on Wall Avenue had been reasonable by comparability. The S&P 500 slipped 0.3 per cent, clawing again the vast majority of the losses that had taken it down as a lot as 2 per cent early within the buying and selling day. Roughly three quarters of the shares inside the benchmark index had been decrease at 3pm in New York, with Tesla — which on Monday traded for the primary time as a part of the S&P 500 — main the declines.

The tech-heavy Nasdaq Composite dropped 0.1 per cent. Measures of anticipated volatility on Wall Avenue additionally picked up, with the Cboe’s Vix index rising to 24.7.

On Saturday, Boris Johnson, UK prime minister, introduced the tightest social restrictions for the reason that March lockdown for greater than 16m individuals in south-east England, together with London. He additionally warned {that a} new mutation of Covid-19 was as much as 70 per cent extra transmissible.

The pound dropped 0.4 per cent to $1.347, as continental European governments banned journey from the UK. The restrictions come simply as officers in Brussels and Westminster close to the most recent deadline in post-Brexit trade talks. In opposition to the euro, the pound fell 0.2 per cent to €1.099.

Brent crude settled 2.6 per cent decrease at $50.91 a barrel. The worldwide benchmark had traded as excessive as $52 this month for the primary time since coronavirus swept into Europe within the spring, boosted by optimism about vaccines, however new lockdowns threaten oil demand.

“Buyers concern the brand new pressure is already in continental Europe and it’s only a matter of time earlier than we see contemporary measures in Europe to include it,” mentioned Emiel van den Heiligenberg, head of asset allocation at Authorized & Normal Funding Administration. “We should always assume it has unfold to the US as effectively.”

Gregory Perdon, co-chief funding officer at non-public financial institution Arbuthnot Latham, added that market strikes could possibly be extra pronounced on Monday than they usually would have been due to skinny buying and selling volumes within the run-up to Christmas.

“There’s at all times a way of warning about buying and selling round Christmas as there’s concern over whether or not markets can accommodate regular order flows,” he mentioned. “And all of us try to wind down.”

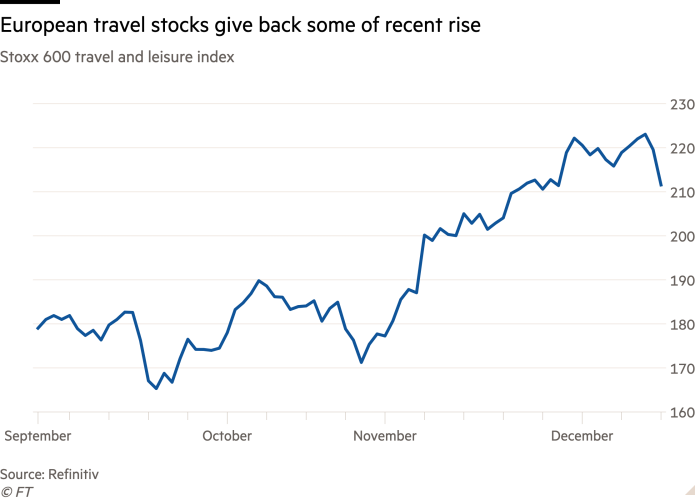

The sell-off hit firms throughout sectors, with journey and hospitality teams notably exhausting hit. British Airways and Iberia proprietor IAG fell 8 per cent, whereas Wynn Resorts and MGM Resorts declined greater than 2 per cent.

The yield on the 10-year Treasury was little modified at 0.94 per cent whereas the greenback rose marginally.

An settlement by US lawmakers on a close to $900bn stimulus package to assist small companies and fund direct funds to American households struggling within the coronavirus pandemic did not brighten market sentiment.

“The contemporary virus concern overshadowed constructive information that lawmakers within the US have lastly reached a deal,” after months of wrangling, commented Mark Haefele, chief funding officer at UBS Wealth Administration.

“The settlement on a $900bn Covid aid invoice meets our base case expectation,” analysts at Morgan Stanley mentioned. They added, nonetheless, that they had been watching “legislative language” across the Federal Reserve’s emergency lending facilities as “a extra appreciable threat over the long run”.

Further reporting by Philip Georgiadis